Voluntarily you can register for VAT if you’re sales are under £85,000 per year. But as soon as your sales exceed this amount you will need to register for VAT. In this article we will be weighing up pros and cons of voluntary VAT registration so you have better information before speaking with your accountant specifically for the pressure washing business.

We will explore the concept of VAT as it related to a pressure washing service business. The advantages and disadvantages of voluntary registration, the psychological aspect of VAT limits, and the basics of inbound and outbound VAT. Additionally, we'll discuss how VAT registration can benefit your business by allowing you to offset VAT against your equipment and consumable costs and also making your business look more credible.

What is VAT?

VAT is essentially a tax on consumption. It is applied on the difference between a business's sales and purchases. When your customers pay VAT on your services at 20% (output VAT) on top of the price you charge. You are essentially collecting this on behalf of HM Revenue and Customs (HMRC).

On the flip side, you can reclaim the VAT you've paid (input VAT) on your business expenses such as clothing, chemicals and equipment. This process can have a significant impact on your cash flow and overall financial health.

How to work out VAT?

The basic of VAT are simple, there the price you charge customer before you are registered to collect VAT which is what you mare charging now, and you collect 100% of this price.

Then the price after you are VAT registered, which typically will have an extra 20% added on top (this 20% you are collecting on behalf of HMRC)

To work out prices with or without VAT we have added a free VAT calculator to the

Pressure Washing Calculator available on the Apple store.

It allows you to either add or deduct the VAT from any price.

Set your Tax Rate

Slide the bar to adjust tax %

Add / Remove Tax

Either Add or Remove Tax?

Calculator show the taxs clearly

Understanding Input VAT and Output VAT

Input VAT and output VAT refer to the VAT you pay on purchases and the VAT you charge your customers. Understanding the basics of these concepts is crucial for managing your VAT obligations.

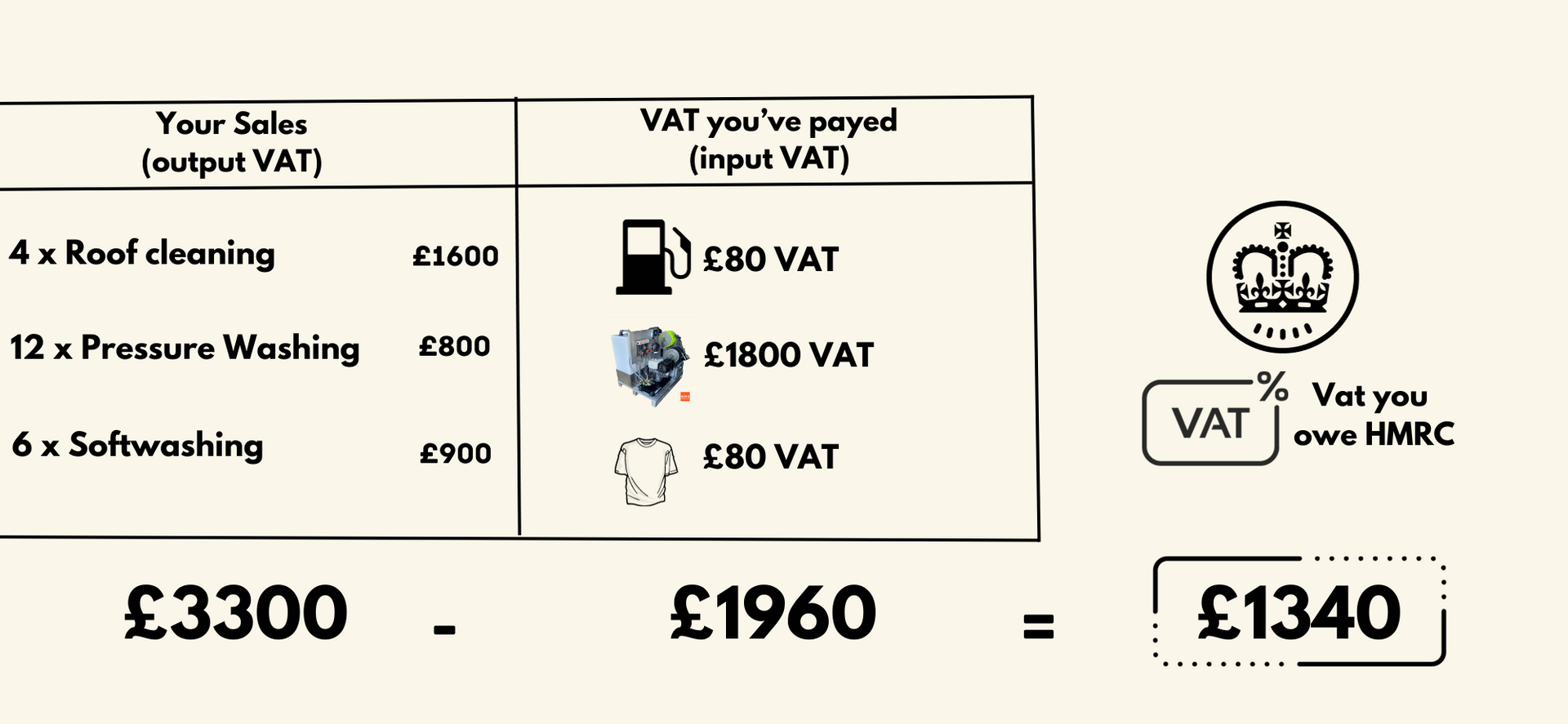

Using the image below, lets run through an real pressure washing business VAT situation.

For Example if you make £16,000 in sales, 20% of this would be VAT = £3300 (Output VAT)

But you invested in new equipment, fuel and clothing for the business totalling £11,760, 20% of this would have been VAT = £1960 (Input VAT)

This means the amount you owe it HMRC is now £3300 (input Vat on Sales) - £1960 (output VAT expenses)=

£1340

“You have successfully collected £1340 VAT commonly known as consumption tax on behalf of HMRC.”

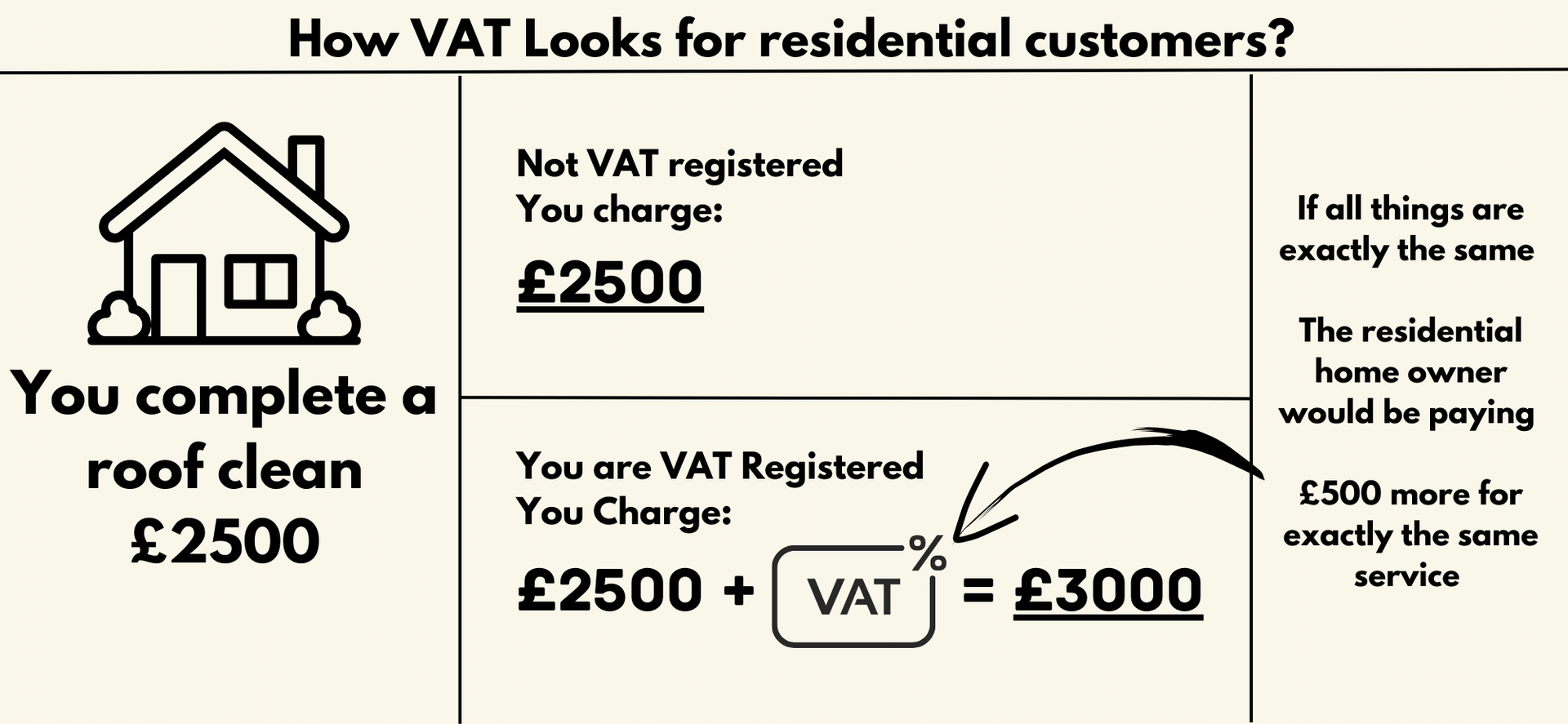

Will your residential customers like you charging them VAT?

Once you become VAT registered 20% will be added on top of your prices.

This 20% is not your money, it goes straight to HMRC.

If you are still competing on price, which is not recommended. Your prices compared with the exact same service from another provider would be 20% higher for the customer.

The Disadvantages of Voluntary VAT Registration

1. Administrative Burden

VAT registration comes with additional administrative responsibilities, including keeping detailed records, filing regular VAT returns, and complying with HMRC regulations. This can be time-consuming, annoying and may require additional staff or resources.

2. Increased Prices for Customers (Residential)

When you register for VAT, you must charge VAT on your services. This can lead to higher prices for your customers especially if you only offer residential cleaning. Potentially making you less competitive in the market.

3. Complexity in Pricing

Pricing your services can become more complex due to VAT. You'll need to clearly communicate the VAT-inclusive prices to your customers to avoid misunderstandings. Especially when transitioning from NOT VAT registered to becoming VAT registered.

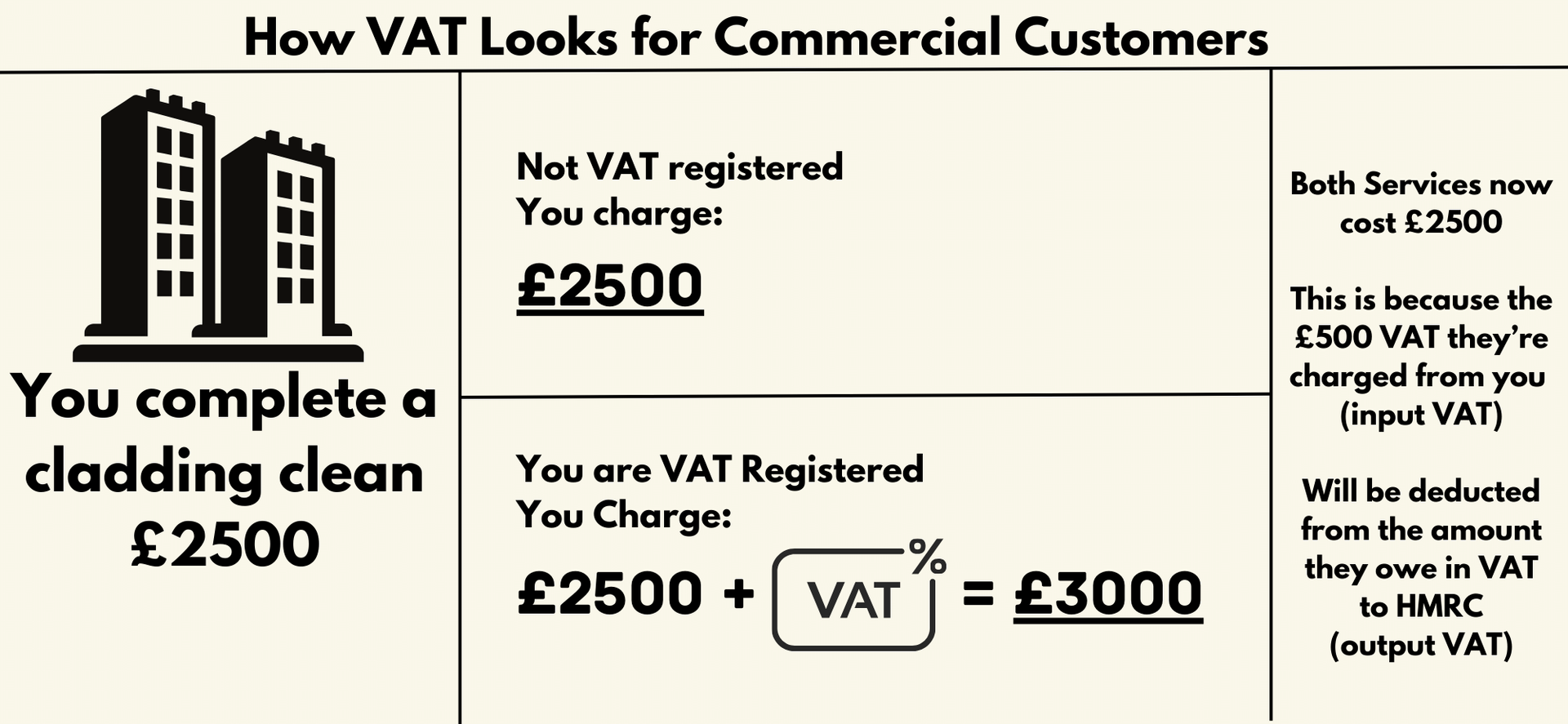

Being VAT Registered and Dealing with Commercial Customers

Its not essential but most commercial clients "expect" you to be VAT registered because the chances are, they're VAT registered too.

Many companies will favour you over another and is actually a selecting criteria in choosing you to work with them over another company.

The Advantages of Voluntary VAT Registration

1. Improved Credibility

Voluntarily registering for VAT can enhance your business's credibility in the eyes of potential clients. It may make you appear more established and professional, which can lead to increased trust and authority when dealing with your customers.

2. Reclaiming Input VAT

By registering for VAT, you can reclaim the VAT you pay on your business expenses, such as equipment purchases and maintenance costs. This can result in substantial savings over time and make your business more cost-efficient.

3. Commercial Cleaning Opportunities

VAT registration is often required for businesses engaged in commercial cleaning trade… When you are getting onboarded by a management company and they're asking for your business details they’ll expect your VAT number. VAT registration can open doors to new markets and clients.

If You Plan on Growing Your Business, You'll Need to Register for VAT Anyway

In Facebook groups, online forums, comment sections small business owners can sometimes scare you with the idea of VAT registration. As your pressure washing business grows, you will naturally surpass the VAT threshold, making VAT registration mandatory anyways.

Planning ahead and making that VAT threshold a goal can be a great one if so pre-planning and registering voluntarily can prepare your business for this transition, avoiding any sudden disruptions to your operations.

The VAT Limit: Is this a Psychological Sales Barrier keeping you small?

Offsetting VAT Against Your Equipment Costs

One of the significant advantages of VAT registration is the ability to offset VAT against your equipment costs. This means that the VAT you pay on pressure washing equipment purchases can be reclaimed, reducing your overall expenses.

Speak with your accountant

They know you personally and your business too.

The information in the article is designed to help you get some information relevant to the pressure washing business.

I'm Daniel Dennett, I own a pressure washing business that is VAT registered.

The information I provide here is from experience not opinion.

Please speak with your accountant and together you can make a decision to what is best for your business.